Specialist risk consultancy, Control Risks (www.controlrisks.com), and its economics consulting partner, Oxford Economics Africa (https://www.oxfordeconomics.com/), announced the launch of the eighth edition of their Africa Risk-Reward Index today, themed ‘Opportunity through adversity’.

The Africa Risk-Reward Index is an authoritative guide for policymakers, business leaders, and investors.

The report details developments in the investment landscape in major African markets and delivers a grounded, longer-term outlook of key trends shaping investment in these economies.

The eighth edition of the Africa Risk-Reward Index is released at a time of geopolitical fragmentation and recent external shocks that will have a sustained impact on the African continent.

African nations are contending with the lingering repercussions of the COVID-19 pandemic, disruptions in global supply chains due to the conflict in Ukraine, and a tightening of global financing conditions. According to Oxford Economics Africa, these factors have pushed GDP growth down from 5.4% in 2021 to 3.5% last year.

Some of this weakness has persisted into this year, but Oxford Economics Africa anticipates a steady, albeit uneven, pick-up in economic activity in the next 12-18 months.

The report examines three key themes outlined below, summarising Control Risks’ and Oxford Economics Africa’s views on Africa’s trajectory in the year ahead.

The profits and pitfalls in polarisation

The report’s first theme is the impact of global geopolitical fragmentation on Africa.

The conflict in Ukraine has upended the geopolitical landscape: Western countries are seeking alliances on their stance against Russia, while Russia is also looking to gain support for its efforts in Ukraine.

Beyond the geopolitical heavyweights, other emerging geopolitical “middle powers” are taking an interest in Africa and its rich resource potential.

As jostling for influence continues, the shockwaves from the conflict have rippled out in the form of macroeconomic uncertainty and higher inflation, deep anxiety over the interconnectedness of global trade and economic systems, and a desire among global geopolitical powers to distinguish friends from foes.

Conscious of their growing geopolitical stock, Africa’s largest economies are seeking to balance their desire for neutrality and their need for external financial support, while at the same time seeking to amplify Africa’s voice in global debates. But their attempts at non-alignment are coming under ever greater pressure. Companies will be required to navigate the resulting regulatory complexity arising from global polarisation, including competing regulatory regimes, sanctions and export controls, and growing scrutiny on companies’ supply chains.

African-led security interventions A collateral effect of the polarisation mentioned above is the upswing in African-led security interventions, which make the report’s second key theme.

Global attention is split as the conflict in Ukraine continues, the US-China competition heats up, and countries in the Global North are increasingly focused on their domestic political concerns. The perceived inability of external forces to aid in bringing lasting security is leading African governments and institutions to gradually take on a greater role in responding to security crises on the continent.

“These changes in tackling insecurity will present challenges for policymakers and businesses in Africa in the coming years. Businesses will be forced to navigate a more complex operating environment where military force, regional competition, and political and business interests are intertwined”, said Patricia Rodrigues, Associate Director at Control Risks.

It will require careful monitoring of rapidly evolving security dynamics, and heightened efforts to maintain neutrality and avoid the potential reputational fallout.

Operators working in conflict zones will also potentially have to navigate interactions with foreign or private military forces.

Financing for the future We anticipate that increased geopolitical competition will in the longer term translate into new opportunities for African countries, as geopolitical powers seek to extend their influence through financing and investment.

However, in the short term, African economies will continue to contend with challenging economic environments, and this will deter the more risk averse investors.

Rising inflation and supply-chain constraints have exposed the continent’s imbalances and economic fragilities.

“The Russia-Ukraine conflict and a tightening in global monetary conditions have unnerved international investors. This has raised concern that economic development on the continent might pause or even regress. One area where this has not been the case is financial services, and more specifically, the expansion of access to financial services through innovation,” said Jacques Nel, Head of Africa Macro at Oxford Economics Africa.

While foreign investors have somewhat retreated to the perceived safe havens of advanced economies, home-grown African champions are emerging to fill this funding gap and are steadily consolidating their dominance in Africa’s financial services industry.

The continent still has a long way to go to reach financial inclusion to the extent seen in more advanced economies. However, financial institutions from regional economic powerhouses South Africa, Egypt, Nigeria, Morocco, and Kenya are stepping in to help bridge access and inclusion divides.

While the sector is likely to remain attractive for investors, there are still significant risks, including exposure to governance issues, fraud, cyber threats, vulnerability to terrorism financing, and growing international scrutiny of illicit financial flows.

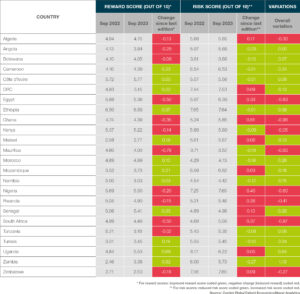

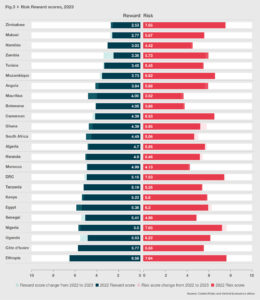

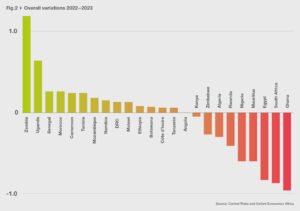

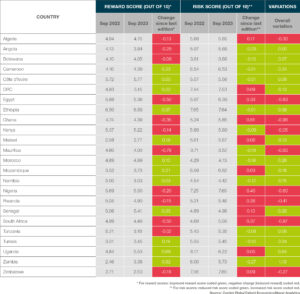

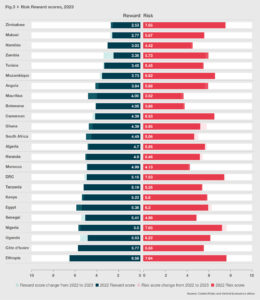

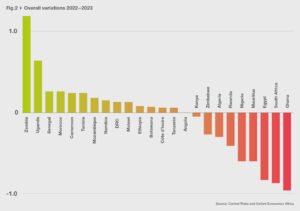

The Africa Risk-Reward Index is defined by the combination of risk and reward scores that integrate economic and political risk analysis by Control Risks and Oxford Economics Africa.

Risk scores from each country originate from the Economic and Political Risk Evaluator (EPRE), while the reward scores incorporate medium-term economic growth forecasts, economic size, economic structure, and demographics.

By Maurice Momanyi.

By Maurice Momanyi.