- EIB Vice President confirms EIB support for green hydrogen engagement with President Ruto

- New agreement to develop and unlock investment to produce green hydrogen using renewable energy

- EIB and Kenya to identify potential green hydrogen investment projects

- New green hydrogen cooperation follows four decades of EIB backing renewable energy in Kenya

The European Investment Bank, the world’s largest multilateral bank and leading global financier of renewable energy, will strengthen support for green hydrogen investment in Kenya.

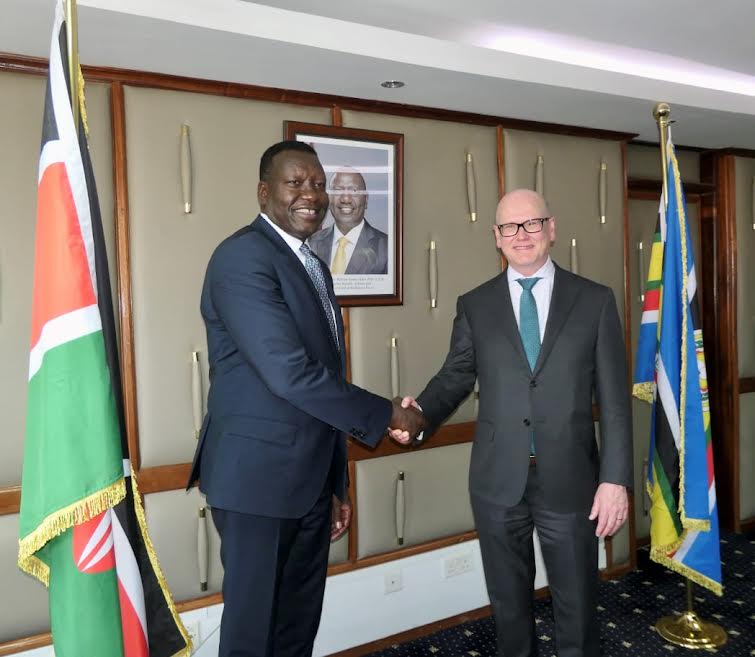

Thomas Östros, European Investment Bank Vice President and Professor Njuguna Ndung’u, Cabinet Secretary, National Treasury and Economic Planning signed the Joint Declaration on Renewable Clean Hydrogen following discussions on green hydrogen investment with William Ruto, President of the Republic of Kenya.

“Kenya has some of the best renewable energy sources in the world if the storage components were equally developed. The route to storage has the potential to develop green hydrogen to deliver sustainable, green and inclusive growth. Today’s agreement builds on decades of close cooperation with the European Investment Bank to support renewable energy across Kenya. Together we will develop projects that will develop green hydrogen as part of the Kenya Energy Roadmap 2040 ” said Professor Njuguna Ndung’u, Cabinet Secretary, National Treasury and Economic Planning.

“Kenya’s wind and solar power can be harnessed to produce green hydrogen and provide affordable power for economic development and industrial growth. The Joint Declaration between Kenya and the European Investment Bank will improve understanding of how best to identify, structure, unlock and implement green hydrogen investment. Development of green hydrogen in Kenya has the potential to enable 100% of Kenya’s energy needs to be supplied by clean power.” said Davis Chirchir, Cabinet Secretary, Ministry of Energy.

“As part of Team Europe, the European Investment Bank stands ready to enhance cooperation to develop public and private sector investment that uses wind, solar and geothermal resources to produce green hydrogen, combat climate change, and support economic development in Kenya. Our energy and finance experts at the EIB Regional Hub in Nairobi and at headquarters will work closely with Kenyan partners to identify and develop new renewable energy projects and unlock construction of hydrogen production infrastructure.” said Thomas Östros, European Investment Bank Vice President.

“The European Union and Kenya are committed to tackling climate change and increasing use of renewable energy. The new agreement between the EIB, the EU Bank, and Kenya will accelerate identification and investment in green hydrogen in Kenya and harness renewable energy to deliver affordable and sustainable energy.” said H.E. Henriette Geiger, European Union Ambassador to Kenya.

The new agreement will strengthen cooperation to support the development of green hydrogen schemes in Kenya. The EIB expects to initially mobilise EUR 1.8 million of grants from the European Union and to appraise possible loan financing for larger green hydrogen related investment.

Over the last decade the European Investment Bank has provided more than EUR 5.3 billion for energy investment across Africa, including EUR 418 million for geothermal, wind and solar investment as well as grid investment in Kenya.